Why Is Everyone Buying Ethereum? A Deep Dive into the Second-Largest Cryptocurrency

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has emerged as a must-have asset for both seasoned investors and crypto newcomers. While Bitcoin often steals the spotlight, Ethereum’s unique features, utility, and growth potential have driven widespread adoption. But what exactly makes Ethereum so appealing, and why is everyone buying it? Let’s explore the reasons behind Ethereum’s popularity and its role in shaping the future of the blockchain ecosystem.

The Basics of Ethereum

Ethereum is a decentralized blockchain platform that goes beyond simple transactions. Created by Vitalik Buterin and launched in 2015, Ethereum introduced the concept of smart contracts—self-executing agreements with terms directly written into code. These contracts enable developers to build decentralized applications (dApps) that run without intermediaries, revolutionizing industries like finance, gaming, and supply chain management.

At the core of Ethereum’s ecosystem is its native cryptocurrency, Ether (ETH). While Bitcoin is primarily seen as digital gold or a store of value, Ether serves as the fuel for executing operations on the Ethereum network. This dual role has made Ethereum indispensable in the blockchain world.

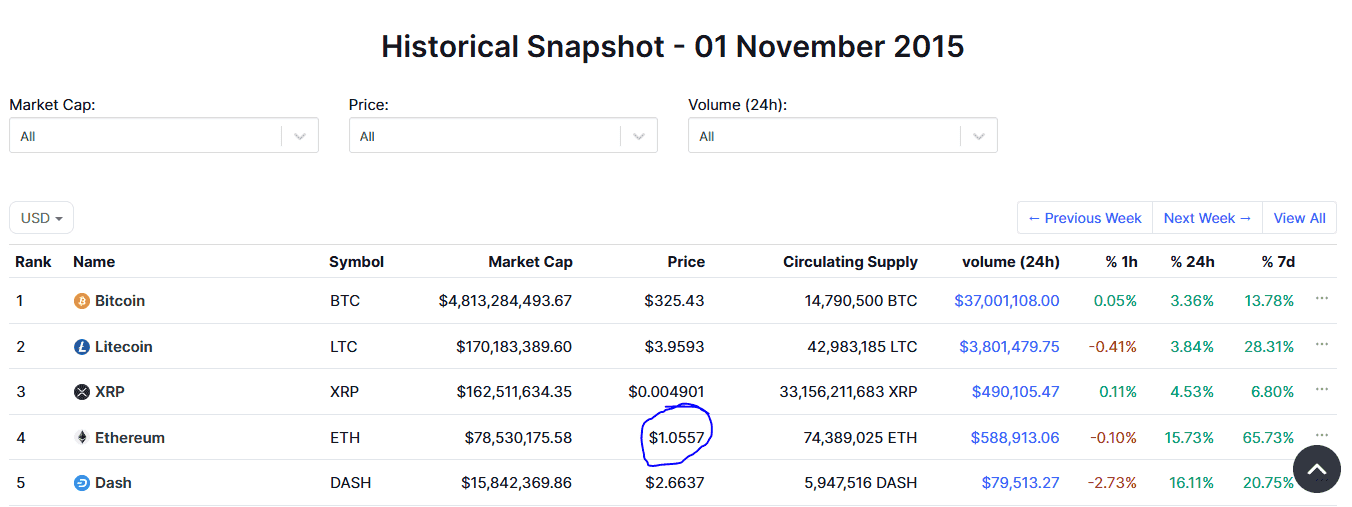

Ethereum Price in 2015 and Now: A Transformational Journey

Ethereum’s journey since its inception in 2015 has been nothing short of remarkable. When Ethereum launched, the price of Ether (ETH) was modest. During its initial crowd sale, ETH was priced at around $0.30 per token. By the time the network went live in mid-2015, Ether traded between $1 and $3. This low entry point attracted early adopters, developers, and visionary investors who believed in the blockchain’s revolutionary potential.

Fast forward to today, and Ethereum’s price tells a completely different story. As of early 2025, ETH trades in the range of $1,800 to $2,000, with past peaks reaching over $4,800 in late 2021 during the cryptocurrency bull run. This exponential growth represents a staggering return on investment, highlighting Ethereum’s dominance in the blockchain ecosystem.

Several factors have contributed to Ethereum’s price increase:\n\n- Mass Adoption: The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) has driven demand for Ether, which powers these ecosystems.\n- Ethereum 2.0: The ongoing upgrades have enhanced scalability and energy efficiency, making the network more attractive to users and investors.\n- Institutional Interest: Big players like Grayscale and CME Group have brought Ether into the mainstream investment sphere, boosting confidence and liquidity.

However, it’s not just the price that matters—it’s the underlying innovation and utility that continue to attract buyers. Whether you’re looking at Ethereum’s early days or its current dominance, its journey showcases the transformative power of blockchain technology.

Key Reasons Behind Ethereum’s Popularity

1. Smart Contract Functionality

Ethereum’s ability to host smart contracts is its most defining feature. These programmable contracts eliminate the need for intermediaries, reducing costs and increasing efficiency. For example:

- DeFi Revolution: Decentralized finance (DeFi) platforms built on Ethereum allow users to borrow, lend, and trade assets without traditional banks.

- NFT Boom: Ethereum is the backbone of the non-fungible token (NFT) market, enabling artists, creators, and collectors to tokenize and trade digital assets.

The versatility of smart contracts has made Ethereum the go-to platform for innovation in blockchain technology.

2. The Transition to Ethereum 2.0

Ethereum’s ongoing upgrade to Ethereum 2.0 (ETH 2.0) has generated significant excitement. This transition involves moving from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism, which promises:

- Scalability: Increased transaction speed and capacity to handle more users.

- Energy Efficiency: A dramatic reduction in energy consumption compared to Bitcoin’s PoW system.

- Enhanced Security: Improved network resilience against attacks.

These upgrades position Ethereum as a sustainable and future-ready blockchain, attracting both environmental advocates and institutional investors.

3. DeFi Ecosystem Growth

The DeFi sector—a collection of financial services powered by blockchain—has flourished on Ethereum. Platforms like Uniswap, Aave, and Compound offer decentralized trading, lending, and yield farming opportunities. This ecosystem has unlocked new ways for individuals to earn passive income and manage their finances, driving massive demand for Ether as a utility token.

4. NFT Dominance

Non-fungible tokens have taken the world by storm, and Ethereum is the primary blockchain powering this market. From digital art and music to virtual real estate, NFTs have introduced new ways of owning and monetizing assets. Ethereum’s ERC-721 and ERC-1155 token standards provide the technical foundation for NFTs, making it the preferred choice for creators and collectors.

5. Institutional Adoption

Ethereum has garnered significant interest from institutional investors, further solidifying its status as a blue-chip cryptocurrency. Companies like Grayscale, MicroStrategy, and CME Group have incorporated Ether into their portfolios and offerings, signaling confidence in its long-term potential.

Moreover, Ethereum’s programmability appeals to enterprises exploring blockchain solutions for supply chain tracking, identity management, and more. This broad range of applications ensures continued demand for Ether.

6. Developer-Friendly Ecosystem

Ethereum’s robust developer community and open-source nature make it a hotbed for innovation. With tools like Solidity (its programming language) and frameworks like Truffle, Ethereum has empowered developers to create thousands of dApps. This thriving ecosystem keeps Ethereum at the forefront of blockchain adoption.

7. Liquidity and Accessibility

As one of the most traded cryptocurrencies, Ether boasts high liquidity across global exchanges. This makes it easy for investors to buy, sell, and trade ETH at any time. Additionally, Ethereum’s widespread availability on platforms like Coinbase, Binance, and PayPal has made it accessible to retail investors worldwide.

8. Hedge Against Inflation

Like Bitcoin, Ethereum is seen as a hedge against inflation and economic uncertainty. While Ether’s supply isn’t capped like Bitcoin’s, the introduction of Ethereum Improvement Proposal 1559 (EIP-1559) has added a deflationary mechanism by burning a portion of transaction fees. This feature enhances ETH’s scarcity and long-term value proposition.

Real-World Use Cases of Ethereum

Ethereum’s impact extends beyond speculation. Here are some notable real-world applications:

- Decentralized Exchanges (DEXs): Platforms like Uniswap enable peer-to-peer trading without intermediaries.

- Gaming: Blockchain games like Axie Infinity and Decentraland are built on Ethereum, offering play-to-earn models.

- Identity Verification: Ethereum powers decentralized identity solutions, enhancing privacy and security.

- Supply Chain Management: Companies use Ethereum to track and verify goods throughout supply chains.

- Crowdfunding: Ethereum’s Initial Coin Offerings (ICOs) and token sales allow projects to raise funds directly from the community.

Challenges and Criticisms

Despite its many strengths, Ethereum is not without challenges:

- High Gas Fees: Network congestion has led to skyrocketing transaction costs, pricing out smaller users.

- Scalability Issues: Until ETH 2.0 is fully implemented, scalability remains a concern.

- Competition: Rival blockchains like Solana, Binance Smart Chain, and Cardano are vying for market share with faster and cheaper solutions.

These challenges underscore the importance of Ethereum’s transition to ETH 2.0 and ongoing development efforts.

The Future of Ethereum

Ethereum’s roadmap includes significant upgrades aimed at enhancing scalability, security, and usability. Key milestones include:

- Shard Chains: Dividing the blockchain into smaller parts to improve efficiency.

- Layer-2 Solutions: Technologies like Optimism and Arbitrum aim to reduce congestion and fees.

- Adoption by Enterprises: Continued integration with mainstream businesses and institutions.

As these developments unfold, Ethereum is poised to maintain its leadership in the blockchain space.

Conclusion

Ethereum’s widespread adoption is driven by its unparalleled utility, innovation, and growth potential. From powering DeFi and NFTs to enabling decentralized applications, Ethereum has become the backbone of the blockchain ecosystem. Its ongoing upgrades and expanding use cases make it a compelling choice for investors seeking exposure to the cryptocurrency market.

However, like any investment, buying Ethereum comes with risks. Prospective investors should conduct thorough research, stay informed about market trends, and diversify their portfolios. With its transformative potential, Ethereum remains a cornerstone of the blockchain revolution—and a top pick for those looking to invest in the future of decentralized technology.